Last week, we introduced the broad concepts and structures of the Real Estate Investment Trust (REITs) – here we will seek to disaggregate the REIT universe into some of its key (as we see them) component parts.

(All the graphs & data included herein are internally produced from publicly available information. Whilst they are fairly statistically rigorous – I allow that there may be errors present. Whilst the overall presentations made are well indicative, they are not meant to be taken as gospel as to individual data-points or methodologies.)

4. The REIT landscape by segment – how different models behave

The UK REIT universe is anything but homogeneous – as might be expected, bearing in mind the sectoral differentiation of the assets that make up the CRE universe. A few broad families are visible if we squint a bit. (The boundaries blur, but the distinctions are useful, for all that.)

4.1 Income-core and “infrastructure-adjacent” REITs

These are vehicles that own assets which look and feel close to the underlying infrastructure:

- Long-lease supermarket portfolios, where tenants are often investment-grade and rents are frequently index-linked.

- Certain healthcare, social housing or ground-rent vehicles (subject to today’s regulatory and political scrutiny).

The strategic aim is to provide relatively predictable, inflation-linked cashflows backed by long leases to strong counterparties. Annual reports from specialist grocery REITs, for example, emphasise a combination of secure, growing income and long-dated leases to major operators.

As a direct investor – we like to have some ‘long income’ as part of our portfolio. This aims to provide the certainty of a guaranteed income (ideally to a strong covenant), without frequent breaks, lease renewals, etc. A good example of this for us would be our 2025 acquisition of the Old Buttercross public house in Rutland – a decades long term certain, with regular inflation-based rent reviews and to a solid, institutional grade tenant.

From a risk perspective, these vehicles can behave more like income securities with duration and regulatory risk, rather than like opportunistic property & capital plays driven by rental reversion. Indeed – these are almost ‘bond like’ in nature.

4.2 Sector-specialist operating REITs

Here we find:

- Logistics and industrial platforms.

- Retail warehousing and convenience-led retail.

- Alternatives such as self-storage, student accommodation or urban logistics hubs.

- (Sometimes including what we consider as ‘operating RE’ rather than ‘asset RE’ such as a number of self-storage REITs)

These REITs often combine a strong operational overlay (asset management, development pipeline, active leasing) with relatively concentrated sector bets. Fact sheets from sector-focused REITs commonly highlight metrics such as EPRA earnings growth, like-for-like rental uplifts and sector-leading cost ratios as key value drivers.

They are more exposed to rental variation and cap-rate spreads than to pure “bond-like” income, and their valuations are sensitive to both property fundamentals and equity-market views on where they are in the cycle.

4.3 Diversified and regional REITs

At the more traditional end of the spectrum sit diversified REITs owning mixtures of offices, industrial and retail, sometimes with a regional skew. Interim and annual reports from such REITs over the last 18–24 months frequently reference:

- Revaluation losses as (asset level) yields have moved out;

- Strategies to reduce leverage via disposals; and

- A continued focus on dividend cover and EPRA-style net tangible asset metrics.

These vehicles can look closer to a listed proxy for a diversified property fund, with varying degrees of active asset management, and their risk/return sits between the income-core and sector-specialist poles.

4.4 REIT Performance

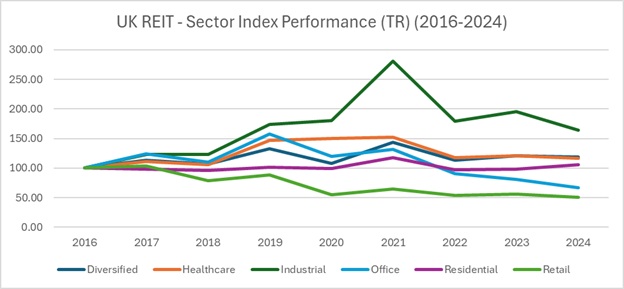

It is of vital importance to consider REITS in the context of their sector – rather than just as a proxy for ‘the property market’ – there is a glut of variation in performance:

REIT Sectoral Basket Performance (Indexed 2016)

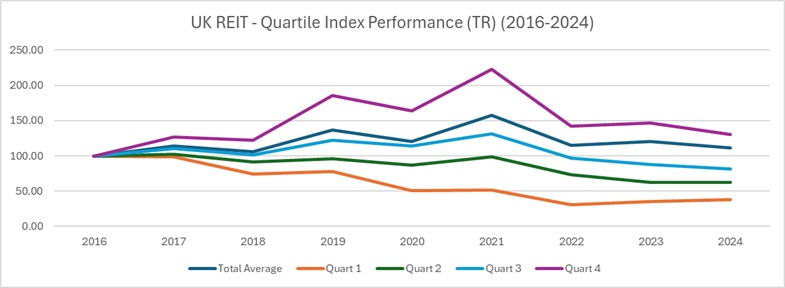

Even more than this – we must consider the underlying REIT itself – for even within sector baskets, we see hugely wide ranges of performance:

REIT Quartile Performance

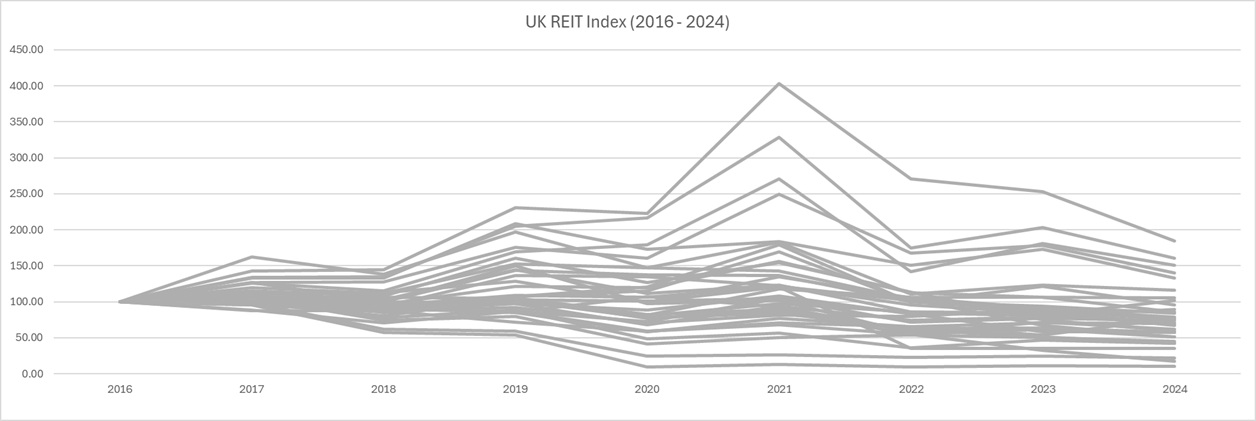

REIT Universe Performance (Indexed 2016)

A wide range of performances indeed – and such performance needs much further disaggregation to understand ‘why’ – poor asset performance, good asset management, structural strengths/weaknesses – etc. This is much more than looking at the underlying assets & the management & capital stack, as with private vehicle.

5. REITs versus direct mid-market CRE – how we think about them

From Manston’s vantage point as a mid-market, hands-on investor, REITs are not a substitute for direct property – but they are part of the same ecosystem, and the interaction between them matters.

A few lenses we find useful:

5.1 Control versus convenience

- Direct ownership gives full control over business plans, financing, capex and exit timing – but demands capital, time and specialist resource.

- REIT exposure offers instant diversification, daily liquidity and the ability to scale in or out via the stock market, but at the cost of line-by-line control.

For those whose edge lies in lease engineering, local knowledge and asset-specific value creation, direct ownership remains the more natural habitat. For those seeking sector exposure and yield without building an in-house asset management platform, REITs can be an efficient route.

5.2 Pricing signals

Listed REITs also function as a kind of “live poll” on property risk. When discounts blow out in a particular segment, it may be signalling concerns about:

- Future rental levels (e.g. secondary offices facing obsolescence);

- Balance sheet stress (gearing, covenant headroom, hedging rollover); or

- Liquidity (investors demanding a higher premium to hold illiquid or structurally challenged assets).

- Valuation concerns – is the NAV the real NAV?

These signals do not automatically translate into direct market pricing – transactional evidence often lags – but they are part of the backdrop when under-writing new acquisitions or considering disposals.

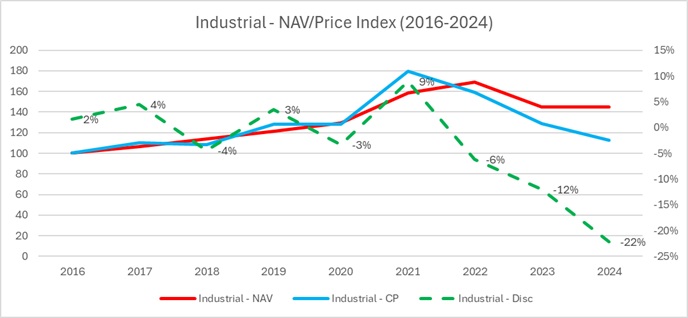

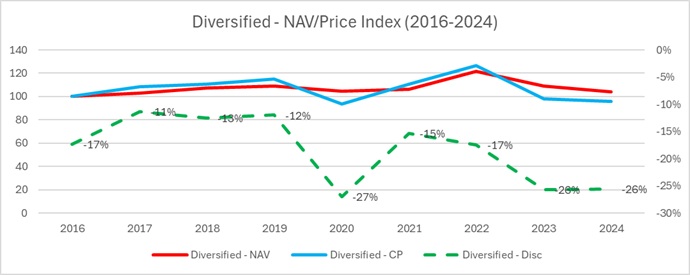

The risk here of course is that you get a pricing ‘double whammy’ – red book valuations reel values in, and then the market over-reacts and reels them in further (and, indeed vice versa in a bull market!). This can be illustrated by the passing deltas between share price performance and underlying NAV performance:

Industrial Basket – NAV, Closing Price and Discount

Diversified Basket – NAV, Closing Price and Discount

So – as an investor – you are not just looking to the performance of the underlying assets (as a fully private investor needs to), but also to the ‘Structural’ layer atop of the assets, which generates the share price returns (capital and income). Whilst this can provide significant ‘value investor’ opportunity, if the delta closes – this is by no means ‘baked in’ and remains a source of risk and uncertainty.

At Manston – we would (obviously!) argue that (if regulatory & financial circumstances allow) then direct investment (suitably stewarded) can be just as important a part of an overall portfolio as REIT led indirect – not better, not worse – but different, and fulfilling a different role.

5.3 Structural role in the market

The REIT regime also shapes the market from the inside. Because property rental profits can be exempt from corporation tax within the ring-fence, subject to the 90% distribution rule and the other conditions, REITs are natural homes for long-term income portfolios.

At the same time, rule changes allowing certain unlisted and single-property structures have made the regime more accessible to institutional and professional capital that might previously have used traditional property companies or unit trusts.

For a mid-market investor, this means:

- More potential buyers and sellers in certain asset types (particularly larger, long-income or specialist assets).

- A more nuanced competitive landscape, where some counterparties are governed by REIT constraints (distribution, gearing tests, balance-of-business rules) and others are not.

Understanding who sits on the other side of the table, and what their structural constraints are, becomes part of pricing risk and negotiating intelligently.

6. What to watch next in the UK REIT landscape

Looking ahead, a few themes seem likely to shape the UK REIT landscape over the coming cycle:

- Further regulatory fine-tuning. HMRC and HM Treasury have shown a willingness to adjust the REIT rules in response to market developments – from listing requirements to single-asset conditions and detailed guidance updates. Investors should expect more “evolution not revolution”, particularly around how the regime interfaces with alternative asset classes, ESG requirements and capital-raising structures.

- Debt, duration and refinancing. As with direct property, the profile of each REIT’s debt book (maturities, hedging, covenants) will remain a core driver of equity performance. The regime does not protect against poor capital structure decisions – no silver bullet here.

- Listed versus unlisted balance. The growth of private REITs suggests that more capital will access the regime outside public markets. Listed REITs may therefore become more clearly the “liquid tip of a much larger iceberg”, with index moves increasingly influenced by corporate actions (mergers, take-privates, recapitalisations) as well as pure property fundamentals.

- Sector rotation and obsolescence. Structural questions around secondary offices, some retail formats and assets with poor ESG credentials will continue to loom large. REITs with credible capex and repositioning plans may be able to close valuation gaps; those without may find discounts becoming semi-permanent. And, as discussed previously, it is our position that one weakness of the REIT structure is adequately addressing future CAPEX requirements.

Conclusion – REITs as part of the toolkit, not the whole toolkit

From Manston’s standpoint, the UK REIT landscape is best viewed not as a separate world, but as one of several tools in the broader commercial real estate toolbox.

The regime itself is straightforward in concept – tax exemption on qualifying rental profits in exchange for tight distribution and structural rules – but rich in detail, and increasingly flexible after years of incremental reform.

The listed market has delivered a volatile and, in recent years, often bruising ride for investors; yet it continues to offer a liquid, diversified way to access property returns, with discounts and yields that can be attractive for those willing to underwrite the risks.

For a mid-market, asset-specific investor, REITs are unlikely to replace buying the right asset, on the right terms, with the right lease story and the right management & capital structure. But understanding how the REIT regime works – who uses it, how it shapes competition, and what the listed market is signalling – can only improve decision-making in the direct market.

In short:

- REITs are not a magic bullet, nor are they an irrelevance.

- They are a powerful wrapper whose tax, governance and market dynamics now touch almost every corner of the UK commercial property landscape.

- For those prepared to look under the bonnet – at regime rules, capital structures and underlying assets – they can provide both useful information and, sometimes, compelling opportunities.

- Ultimately, however – we at Manston feel more comfortable engaging in direct investment, in-house, feeling that the returns (risk weighted, insofar as possible with a private vehicle) are both higher and more secure – without the double-layering of asset/share price risk and without the capital constraints that we feel can store up trouble for the future.