When Manston looks to invest – we are strongly of the opinion that we are investing in a specific asset, with a specific story – we are not investing in a slice of a homogenous market – be that sectoral, geographical, or some other form of taxonomical description. This is perhaps best illustrated by the pub sector – where Manston recently made its first new investment in some decades.

If asked earlier this year – would Manston invest in another pub, I think the resounding answer would have been ‘no’. However – we have now done just that – and in doing so, gained a renewed appreciation for the importance (as in all markets) of market disaggregation – simply because we wouldn’t buy the (apocryphal – lest I get angry letters from a landlord . . .) ‘Ferret & Lifeboat’ in deepest, darkest Herefordshire, doesn’t mean that we shouldn’t buy ‘The Old Buttercross’ in Oakham.

As with all markets – you need to examine the underlying asset, rather than the taxonomical class. But, in pubs perhaps more than any other sector – the variety within the class is substantial. What we may have considered previously (through dint of significant market research over the past 25+ years) was that the sector is struggling at the moment – as previous social patterns continue to evolve and pubs form a less key part of life now than 30 years ago – a risk profile out of kilter with Manston’s core conservative approach to investment. What we found, however, was a 25 year, inflation-linked income from an institutional grade source at a net initial yield significantly greater than the equivalent bond exposure – a perfect fit for Manston’s broader portfolio.

Among commercial real estate (“CRE”) asset classes, pubs are arguably the most variable — across ownership structures, income streams, operational risks, lease types and investor profiles. From owner-operators running a freehold pub, to tied tenancies under brewery or pub-company models, to long-leasehold “bond-like” exposures held by institutional investors, the pub sector spans a wide spectrum of investment risk/return profiles. This article explores why pubs are so variable and what that means for different classes of investors.

1 Structural variety: a market of three faces

The pub sector’s variability arises from the diversity of its ownership and lease structures. Broadly, three archetypes dominate the market.

1.1 Independent freehold pubs — full operational exposure (and the rise of small private landlords)

At one end sits the independent freehold operator. The British Beer and Pub Association (BBPA) estimates that roughly 19,000 pubs in the UK are operated on a freehold basis — often rural or community-oriented venues that depend heavily on the operator’s own trade and reputation¹.

Owning a freehold pub combines property, business and management risk within a single enterprise. The owner controls all aspects of trading but also bears the full volatility of demand, cost inflation, and regulation.

A related but distinct model is that of small private landlords who own one or several freehold pubs and lease them to individual operators. These landlords are not pub-companies but private investors seeking income, often on full repairing and insuring (FRI) leases with fixed or index-linked reviews. Their tenants carry the trading risk, but the landlord’s return remains indirectly dependent on tenant performance — placing this model midway between direct operation and corporate long-lease exposure. However – there are ways of blending this risk, and aligning interests further, via such mechanisms as turnover linked rents.

1.2 Tenanted and leased pubs — tied and free-of-tie

A large proportion of the UK’s approximately 45,000 (2024) pubs are held under tenanted or leased arrangements². Under this model, a brewery or “pub-company” (“pub-co”) owns the freehold and grants a lease to a tenant.

Two contractual variants dominate:

- Tied leases, under which tenants buy specified products from the pub-co.

- Free-of-tie leases, allowing free procurement, normally in exchange for higher rent.

The Pubs Code etc. Regulations 2016 created the Market Rent Only (MRO) option, permitting qualifying tenants to opt out of supply ties³. The Code—administered by the Pubs Code Adjudicator—was enacted to promote transparency and fair dealing between large pubcos and tenants⁴.

For investors, the tenanted model separates property ownership from trading risk: income derives primarily from rent, while the tenant bears the operational exposure. Sometimes this can only be a technical distinction, a fig leaf if the underlying business does not perform, but sometimes this intermediate layer can provide significant down-side protection to the investor

1.3 Long-leasehold and corporate leaseback models

At the lower-risk end are long-leasehold, covenant-backed assets, commonly held by pension funds or insurance investors. Properties are let to established pub operators—such as Marston’s, Greene King, or Mitchells & Butlers—on leases of 20 years or more, often with CPI or RPI indexation.

According to M&G Investments (A Guide to Long Lease Real Estate, 2019), such assets provide defensive holdings offering inflation-linked cashflows and lower capital volatility than traditional property exposure⁵. In this model, the investor’s return depends on tenant covenant quality and inflation linkage rather than the day-to-day trading performance of the pub.

Further security is derived from the tenant either being directly (or guaranteed by) an institutional grade covenant – e.g. Marstons. There is very limited relative credit risk that needs accounting for – which should, all things being equal, generate a lower, more secure yield.

It was this aspect of ‘The Old Buttercross’ that attracted Manston in their recent investment – long-term, institutional grade income. This played well as part of our overall portfolio mix as a solid, income driven, low risk base to support shorter-term acquisitions and provide portfolio stability.

Whilst a ‘bond like’ security instrument – under the right conditions, the lease can provide a more attractive yield against comparable debt, whilst holding effectively a fixed security (the underlying asset holding residual/land value at the least). A pub let over the long term to a large brewery may conceivably yield 7-8% income (in the right location), against a realistic cost of debt to the same firm of maybe 6% – significant value gap for fundamentally the same security – with the added benefit of fixed security in the form of the underlying VP value of the asset itself.

2 Dimensions of variability

2.1 Operational versus real-estate risk

Under Royal Institution of Chartered Surveyors (RICS) Valuation – Global Standards (VPGA 4, 2023), trade-related properties such as pubs are often valued by reference to their fair maintainable trade—the level of turnover achievable by a reasonably efficient operator⁶. This principle means capital value is inherently tied to operating potential under the lease.

Owner-operators bear full trading volatility; tenanted landlords absorb limited exposure through rent dependence; institutional long-lease investors are largely insulated from trading performance (at an asset specific level, at least).

2.2 Lease terms and rent mechanisms

Pub leases are unusually heterogeneous: tenures range from short occupational tenancies (three-to-ten years) to institutional FRI leases exceeding 25 years. Rent may be fixed, inflation-linked, or turnover-based. Repair obligations and review frequencies vary widely, producing significant income dispersion and potential for significant lease engineering at the non-institutional end of the market.

2.3 Tenant covenant spectrum

Tenant strength spans from single-site licensees to FTSE-listed groups. Naturally – such a wide range of tenants and leases leads to a wide range of yields – all other things being equal.

2.4 Market and locational sensitivity

Because pubs rely on discretionary consumer spending, they can be highly affected by macro-economic issues and changing social norms. Between 2001 and 2006 – estimated total turnover of UK Pubs & Bars increased (adjusting out inflation) by some 15%, but between 2001 and 2017, estimated turnover fell by 2%.7

However, within this larger context – local demographics and competition drive performance also – licensing policy, catchment affluence, and tourism exposure add further divergence.

At an asset specific level – one needs also to be aware of the inherent differences between ‘dry led’ pubs, where food makes up a larger part of their turnover (maybe a country pub vum restaurant) and ‘wet led’ pubs, which may be more prevalent in busy city centres. These differing ‘trade’ fundamentals need to be considered carefully in the context of the market in which they operate.

2.5 Capital expenditure and obsolescence risk

Pubs are capital-intensive assets requiring periodic refurbishment of bars, kitchens, and interiors. Under the RICS profits-method framework, maintainable trade calculations explicitly assume recurring expenditure on fixtures and fittings⁶ – which arguably leaves room for mis-statement of valuations if the lease differs significantly from the ‘norm’. This structural cost requirement increases risk relative to standard commercial property – and particularly careful consideration will need to be given to where this cost will be allocated – tenant or landlord, and fall-back planning in case of tenant bankruptcy to ensure that the asset is ‘market ready’.

3 Comparison with other CRE asset classes

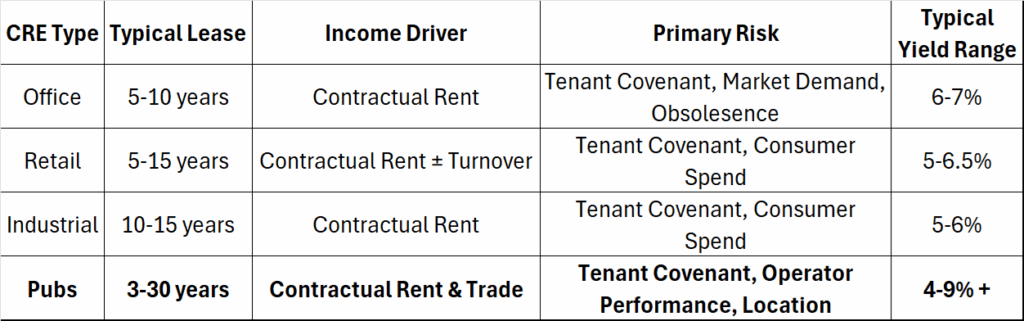

Institutional Grade Assets for Office, Retail & Industrial – various sources.

The yield dispersion quantifies pubs’ variability: the same physical asset can behave either like a small business or an inflation-linked bond. Whilst other classes of CRE clearly have variability – it would seem that pubs offer the broadest spectrum – at least that we have examined in any detail.

4 Financing, valuation, and portfolio implications

4.1 Financing considerations

Where debt service relies on trading income, lenders may classify pubs as operational real estate. Such treatment can lead to higher capital requirements on the lender when compared to traditional (i.e. backed by lease certainty) CRE assets, falling into a higher risk category. Long-lease assets with investment-grade covenants, by contrast, are eligible for lower risk-weight treatment.

4.2 Valuation methodologies

RICS prescribes three primary approaches for trade-related property:

- Profits Method, capitalising maintainable EBITDA or some other measure of relevant profitability (FMOP – Fair Maintainable Operating Profit, for example).

- Investment Method, capitalising market rent at yield, as would be the usual starting point for let commercial property.

- Discounted Cash Flow, where income depends on variable trade in the future, and such variability is to be taken into account.

The coexistence of these bases is less common in other CRE sectors and underscores the pubs’ dual property-and-business character – emphasising the potential inseparable nature of the business from the specific premises it operates from.

To this, we would add the semi-connected value driver of (future) alternate use. When investing in property – Manston always looks for ‘Plan B’, or what we would do if the primary use (Plan A) goes wrong. Pubs often come sitting on relatively large areas of land – including car parks, beer-gardens, play-grounds and the like. This underlying land value, if considered for development can act as a hugely re-assuring backstop to vacant possession value.

4.3 Portfolio strategy

For diversified investors:

- Freehold or tenanted pubs offer higher nominal yields with business-cycle exposure.

- Long-lease, covenant-backed pubs provide predictable, index-linked income.

Allocating across these tiers allows exposure to multiple points on the risk–return curve within a single familiar sector.

5 Structural trends and regulatory context

5.1 Regulatory developments

The Pubs Code etc. Regulations 2016 remains the central legal framework governing large pub-owning businesses³. It mandates fair-dealing, disclosure standards, and tenant rights to MRO status. Whilst this is unlikely to affect a real estate investor into the pub sector, it is important context for the wider market and certainly something to be aware of when comparing pubs in different categories of operation and management.

6 Conclusion

The public house is a uniquely variable CRE asset class. Across its ownership spectrum—freehold, tenanted, and long-leasehold—the underlying allocation of risk differs more than in any other mainstream property type.

- Operational risk ranges from full exposure to near-zero.

- Income stability varies from volatile trade based rents to copper-bottomed index-linked institutional rent.

- Valuation methods span profits, investment, and cash-flow approaches.

- Avg. Yields can vary drastically – potentially stretching from sub-4% to potentially 9%+, historically.8

For investors, this heterogeneity demands rigorous due diligence and clear segmentation but offers exposure across multiple risk profiles within a single, deeply embedded British asset. In a market increasingly seeking inflation-protected and differentiated income, the pub’s structural variability may be its defining strength.

Cheers!

Footnotes

- British Beer and Pub Association (BBPA), Statistical Handbook 2024, Table 2.1 – “Ownership distribution of UK pubs”. https://beerandpub.com/data-statistics

- Office for National Statistics (ONS), Business Demography 2023, SIC 56302 (“Public houses and bars”). https://www.ons.gov.uk

- Pubs Code etc. Regulations 2016 (SI 2016/790). https://www.legislation.gov.uk/uksi/2016/790/contents

- Pubs Code Adjudicator – Guidance 2023. https://www.gov.uk/government/organisations/pubs-code-adjudicator

- M&G Investments (2019), A Guide to Long Lease Real Estate, Institutional Insights Series, Q4. https://www.mandg.com/dam/investments/institutional/shared/en/documents/insights/2019/q4/a-guide-to-long-lease-real-estate.pdf

- Royal Institution of Chartered Surveyors (RICS), Valuation – Global Standards (‘Red Book’), VPGA 4 – Trade Related Properties (2023 Edition). https://www.rics.org/uk/upholding-professional-standards/sector-standards/valuation/red-book/

- Office for National Statistics (ONS), Turnover of public houses and bars, UK, 2001 to 2017. Turnover of public houses and bars, UK, 2001 to 2017 – Office for National Statistics

- Fleurets Survey of Pub Prices (2019). jan2020_surveyofpubprices.pdf